Opening the Stock Market in Israel: Understanding the Key Indicators

Opening the stock market in Israel is a crucial event that impacts both local and international investors. Understanding the key indicators that drive this market can help you make informed decisions. Key indicators provide insights into economic performance, investor sentiment, and market trends. Let’s take a more in-depth look at some of the primary indicators you should monitor.

Major Stock Indices in Israel

In Israel, several stock indices serve as barometers for the market’s health. They include:

- TA-35 Index: This index comprises the 35 largest companies listed on the Tel Aviv Stock Exchange (TASE). It reflects the overall market performance and is often used as a benchmark for investors.

- TA-125 Index: This broader index includes 125 of the largest companies and provides a more comprehensive view of the market.

- TA-Biomed Index: Focusing specifically on the biotechnology sector, this index tracks companies involved in life sciences and health care, areas with high growth potential in Israel.

Market Performance Indicators

When examining the stock market, several performance indicators can assist you in understanding market trends:

- Price-to-Earnings Ratio (P/E Ratio): This metric helps evaluate a company’s stock price relative to its earnings. A higher P/E ratio might suggest a stock is overvalued, whereas a lower P/E ratio may indicate it’s undervalued.

- Dividend Yield: This tells investors how much a company pays out in dividends each year relative to its stock price. A higher dividend yield could indicate a potentially attractive investment.

- Market Capitalization: This figure indicates the total market value of a company’s outstanding shares. Larger companies tend to be more stable, while smaller firms may offer greater growth potential.

Economic Indicators

Several broader economic indicators should also be kept in mind, as they often influence stock market performance:

- Gross Domestic Product (GDP): The GDP growth rate represents the economy’s health and can impact market sentiment. A rising GDP typically encourages investment in the stock market.

- Inflation Rate: High inflation can erode purchasing power and impact corporate profits, which may lead to lower stock prices.

- Unemployment Rate: An indicator of the overall economic situation, a high unemployment rate may signal economic distress and affect market confidence.

Investor Sentiment Indicators

Investor sentiment can greatly impact market performance. Here are key indicators to watch:

- Consumer Confidence Index (CCI): This index measures how optimistic or pessimistic consumers are regarding the economy’s outlook. A high CCI usually correlates with increased spending and investment.

- Market Volatility Index (VIX): This measures market risk and investor sentiment. A higher VIX suggests greater market uncertainty, while a lower VIX indicates calmness.

Company-Specific Indicators

It’s important to consider individual companies before investing:

- Earnings Reports: Quarterly earnings reports provide detailed insights into a company’s financial health. Monitoring these can help you anticipate stock price movements.

- Guidance and Forecasts: Companies often provide guidance on expected future performance. Positive guidance can boost investor confidence and stock prices.

- News and Events: Significant news, such as mergers, acquisitions, or new product launches, can drive stock performance and investor sentiment.

By closely watching these key indicators, you can gain valuable insights into the Israeli stock market. Whether you’re looking to invest in local companies or expanding your portfolio with international stocks, understanding the dynamics of the market will serve you well. Stay informed, and keep your focus on these indicators to make the most out of your investments.

The Role of Market Metrics in Investment Decisions

Understanding market metrics is vital for making informed investment decisions. Investors rely on various indicators to assess the performance of different assets and markets. By analyzing these metrics, you can gain insights into various investment opportunities and risks, facilitating smarter and more strategic decisions.

Investors often look at several core market metrics. Each one provides valuable information that contributes to a comprehensive investment strategy. Here are some key metrics to consider:

- Price-to-Earnings Ratio (P/E Ratio): This metric compares a company’s current share price to its earnings per share (EPS). A high P/E ratio may suggest that a stock is overvalued, while a low ratio could indicate that it’s undervalued.

- Market Capitalization: Market cap is the total market value of a company’s outstanding shares. This allows investors to assess a company’s size and stability. Generally, larger companies are seen as less risky than smaller companies.

- Dividend Yield: This figure measures the cash return on investment from dividends relative to the share price. For income-focused investors, a higher dividend yield can be particularly attractive.

- Debt-to-Equity Ratio: This ratio indicates how a company finances its operations through debt versus wholly-owned funds. A high ratio may signal that a company is heavily reliant on debt, which can be risky in uncertain economic conditions.

- Return on Equity (ROE): ROE measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested. A high ROE is typically a positive sign of growth and efficiency.

These metrics into your investment strategy can reveal different aspects of a company’s performance. For example, if you’re comparing two potential investments, looking at their P/E ratios can help you determine which company might be undervalued or overvalued in the current market. High market capitalization firms often provide more stability, making them suitable for risk-averse investors.

Understanding the broader market impact of these metrics also plays a critical role. Market sentiment can cause significant fluctuations in stock prices, often driven by economic indicators or global events. Therefore, investors should consider the following:

- Market Trends: Keep an eye on current trends in the market. Identifying bullish or bearish trends can help you position your investments accordingly.

- Economic Indicators: Metrics such as unemployment rates, GDP growth, and inflation can impact market conditions. Understanding these indicators helps you predict market shifts.

- Industry Performance: Analyze how different sectors are performing. Some industries thrive during certain economic conditions while others may suffer.

- Technical Analysis: This involves reviewing price patterns and trading volumes to forecast future movements. Investors often use charts to visualize this data for better predictions.

Effective use of market metrics requires ongoing education. You’ll want to familiarize yourself with current market conditions and news that can influence your investments. For example, significant shifts in monetary policy, such as interest rate changes by central banks, can impact market liquidity and investor behavior.

Another important aspect is diversification. Don’t rely solely on a single metric or a handful of investments to dictate your portfolio. By diversifying across various asset classes and regions, you can mitigate some risks and enhance potential returns.

Furthermore, technological advancements have made access to real-time data easier than ever. Numerous platforms provide tools that let you analyze metrics quickly and efficiently. Utilizing these resources can save time and improve your decision-making process.

Investing isn’t a one-size-fits-all approach. Every investor has unique goals, risk tolerances, and timelines. Tailoring your analysis of market metrics to fit your personal strategy will yield the best results. Remember, thorough research and informed decision-making are the cornerstones of successful investing.

Embrace the importance of market metrics in your investment journey. By understanding and applying these key indicators judiciously, you can enhance your investment outcomes and adapt to shifting market conditions with confidence.

Comparing Israeli Stock Market Trends with Global Markets

The Israeli stock market holds a unique position in the global financial landscape. It boasts a mix of local companies that play vital roles both domestically and internationally. Understanding how Israeli stock market trends compare to global markets offers investors key insights into potential opportunities and risks. In this discussion, we’ll delve into some notable trends and comparisons that shed light on Israel’s market dynamics.

One of the most significant factors to consider is the technology sector, which is a powerhouse in Israel. With a high number of startups and established companies in fields like cybersecurity, artificial intelligence, and biotechnology, Israeli companies often show robust growth. In comparison, technology sectors in other countries, like the United States, also experience rapid growth, but the sheer volume of competition can mean that not all companies thrive equally.

The Role of Market Capitalization

Market capitalization is another key indicator when comparing the Israeli stock market to global trends. While the Tel Aviv Stock Exchange (TASE) is sizeable, its market cap is significantly smaller than major exchanges like the NYSE or NASDAQ. Here’s a breakdown:

- Tel Aviv Stock Exchange: Approximately $200 billion

- NYSE: Roughly $25 trillion

- NASDAQ: Around $10 trillion

This difference in size impacts liquidity, volatility, and investment opportunities. Investors in Israel might find that stocks can be more volatile due to lower trading volumes, which may lead to larger price swings in response to market events.

Economic Factors Influencing Trends

The Israeli economy demonstrates resilience, characterized by innovation and a diverse industrial base. However, external economic factors heavily influence stock performance. For instance:

- Global Economic Conditions: Changes in interest rates in major economies like the US affect capital flows into Israel.

- Geopolitical Stability: Regional tensions can lead to cautious investment approaches both domestically and from foreign investors.

- Currency Fluctuations: The strength of the Shekel against the US Dollar and Euro can affect profitability for exporting companies.

When global markets are thriving, Israeli stocks might rise as well, reflecting trends from larger markets. Conversely, during economic downturns, Israeli stocks often mirror international market dips, although the extent may vary due to local conditions.

Sector Performance Compared to Global Trends

Examining sector performances can also reveal interesting comparisons. Key sectors in Israel include:

- Technology: A leader with a vibrant startup ecosystem.

- Healthcare: Significant investments in pharmaceuticals and medical technologies.

- Financial Services: Increasing adoption of fintech solutions.

While technology sectors globally, including in the US and Asia, may face regulatory challenges, Israel’s focus on innovation often positions companies for success. However, the dependency on technology also makes Israeli stocks susceptible to global tech sector trends, as seen during market fluctuations in the tech-heavy NASDAQ.

Emerging Trends in Israeli Markets

As global markets evolve, so do Israeli market trends. A few emerging trends to watch include:

- Investment in Green Technology: There’s a significant shift towards sustainable solutions, tapping into global demand for eco-friendly innovations.

- Health and Biotech Investments: COVID-19 has accelerated investments in health-related industries, leading to growth in biotech stocks.

- Increased Foreign Investment: More foreign investors are looking towards Israel as a destination for tech and innovation, impacting market dynamics.

While the Israeli stock market shows strong potential with its innovation-driven economy, the link with global markets shapes its trends. Investors must stay informed about how changes in the international landscape can affect the performance of Israeli stocks. By recognizing these trends and understanding the unique aspects of both local and global markets, you can navigate the complexities of investing more effectively.

How Economic Events Influence Stock Market Performance in Israel

Economic events play a crucial role in shaping the performance of the stock market in Israel. Understanding the dynamics of these events can help investors make informed decisions. Here are several key economic factors that can influence stock market performance:

1. Interest Rates

Interest rates set by the Bank of Israel significantly impact market performance. When interest rates rise, borrowing costs increase for companies, which can lead to lower profits and decreased stock prices. Conversely, lower interest rates can stimulate growth, encouraging consumer spending and business investment. Investors closely follow these changes, as they adjust their strategies based on the expected impact on corporate earnings.

2. Inflation Rates

Inflation affects purchasing power and consumer confidence. High inflation often drives central banks to raise interest rates, which can negatively impact the stock market. On the other hand, moderate inflation can signal a growing economy, leading to increased stock prices. Monitoring inflation indicators is essential for investors as they gauge how purchasing power changes over time.

3. Economic Growth Indicators

The gross domestic product (GDP) is a primary indicator of economic growth. When GDP is rising, it suggests a strong economy, often leading to increased investment in stocks. Conversely, a declining GDP can trigger fears of recession, causing stock prices to drop. Key indicators of GDP growth include:

- Consumer spending trends

- Business investments

- Government spending

- Net exports

4. Political Stability

Political events such as elections, policy changes, and international relations can significantly influence market performance. In Israel, changes in government or policy toward trade can create uncertainty, leading to increased volatility in the stock market. Investors tend to prefer stability, so any signs of political unrest can prompt them to sell off shares, affecting stock prices.

5. Global Economic Events

Israel’s stock market does not operate in isolation. Global factors such as international trade agreements, economic crises, or changes in foreign markets can impact stock performance. A downturn in major economies like the U.S. or EU can lead to a spillover effect, causing declines in the Israeli market. Investors need to stay informed about global economic news to understand its potential impact on their investments.

6. Corporate Earnings Reports

The performance of individual companies significantly influences stock prices. Quarterly earnings reports serve as critical indicators of company health. Positive earnings surprises can lead to stock price increases, while disappointing results can result in sharp declines. Investors are particularly interested in how these reports align with economic events, as a strong economy may bolster corporate performance, while a weak economy could have the opposite effect.

7. Market Sentiment

Market sentiment refers to the overall attitude of investors toward the stock market. This sentiment is often influenced by news events, economic data releases, and global developments. Positive news can lead to bullish behavior, where investors eagerly buy stocks, while negative news can lead to panic selling. Keeping a pulse on market sentiment allows investors to gauge the market’s mood and adjust their strategies accordingly.

8. Currency Strength

The Israeli shekel’s strength or weakness against other currencies can impact stock market performance. A strong shekel can make exports more expensive, affecting the profitability of companies reliant on foreign markets. Conversely, a weaker shekel can enhance export competitiveness but may increase import costs. Investors must consider currency fluctuations when evaluating companies that operate internationally.

Understanding how various economic events influence stock market performance in Israel empowers you to make strategic investment decisions. By keeping a close eye on interest rates, inflation, political stability, global events, earnings reports, market sentiment, and currency strength, you position yourself to respond effectively to fluctuations in the market. Every investor should cultivate a keen awareness of these factors to navigate the complexities of stock market investments in Israel successfully.

Strategies for Navigating the Israeli Stock Exchange as a New Investor

Navigating the Israeli Stock Exchange can feel overwhelming for new investors. However, with the right strategies, you can make informed decisions and potentially grow your investment portfolio. This guide will help you understand key strategies for successfully entering the stock market in Israel.

Understanding the Israeli Stock Market

Before diving into investing, it’s crucial to understand the Israeli Stock Exchange (TASE). TASE hosts a variety of companies across sectors like technology, agriculture, and pharmaceuticals. The market is known for its dynamic nature and offers numerous investment opportunities.

Start with Research

One of the first steps you should take is conducting thorough research. Here are some aspects to consider:

- Economic Indicators: Keep an eye on economic indicators that affect stock prices, such as inflation rates, interest rates, and economic growth forecasts.

- Market Trends: Study trends in various sectors to identify which industries are on the rise. Technology and renewable energy are examples of thriving sectors in Israel.

- Company Fundamentals: Analyze financial statements of companies you’re interested in. Look for profitability, debt levels, and growth potential.

Diversification is Key

Diversification is a powerful strategy in investment. It involves spreading your investments across various assets to mitigate risk. Here are some tips for effective diversification:

- Sector Variety: Invest in different sectors such as healthcare, technology, and manufacturing to balance your portfolio.

- Geographic Diversity: Consider investing in foreign stocks alongside Israeli companies for additional growth avenues.

- Instrument Types: Mix your investments between stocks, bonds, and ETFs to further minimize risk.

Use a Reliable Brokerage

Choosing the right brokerage is essential for your investment journey. A reliable brokerage not only provides the necessary tools for trading but also gives access to valuable resources. Here are some factors to evaluate:

- Fees: Look for a brokerage with competitive commission rates. High fees can eat into your profits.

- Platform Usability: Ensure that the trading platform is user-friendly, especially if you’re a beginner.

- Research Tools: Opt for a brokerage that offers robust research tools and insights to help you make informed decisions.

Stay Updated with News

Staying informed about the market and economic developments is crucial. Here are a few ways to keep yourself updated:

- Financial News Websites: Regularly read reputable financial news websites and blogs that focus on the Israeli stock market.

- Social Media: Follow finance experts and analysts on social media platforms for real-time insights.

- Market Reports: Subscribe to newsletters or reports that cover TASE performance and company news.

Understand Your Risk Tolerance

Your risk tolerance greatly influences your investment journey. Understanding how much risk you can handle will help shape your investment strategy. Conduct a self-assessment to identify your comfort level with losses and volatility. Based on this assessment, you can decide whether to pursue aggressive or conservative investment strategies.

Set Clear Goals

Before you start trading, set clear financial goals. Ask yourself the following questions:

- What do I want to achieve? Are you looking for long-term growth, quick profits, or retirement savings?

- What is my timeframe? Determine if your investment is short-term or long-term.

- How much can I invest? Assess your finances to come up with a reasonable investment amount.

Monitor and Adjust Your Portfolio

Once you’ve invested, it’s essential to monitor your portfolio’s performance regularly. Look for areas needing adjustment. This could mean reallocating funds toward underperforming stocks or taking profits from those that have exceeded expectations. Regularly re-evaluating your strategy ensures you stay aligned with your goals.

Investing in the Israeli Stock Exchange can be rewarding if approached thoughtfully. With these strategies, you can build a solid foundation for your investment journey. Remember, patience and continuous learning are essential components of successful investing.

Conclusion

As you explore the world of the Israeli stock market, understanding the key indicators becomes vital for making informed investment choices. By familiarizing yourself with market metrics, you can effectively gauge the health and direction of the market, allowing you to strategize your investments better. It is also beneficial to compare Israeli stock trends with global markets. This perspective offers insights into broader economic conditions that may impact local performance.

Economic events play a substantial role in shaping stock market reactions in Israel, from government policies to international developments. Keeping a pulse on these events helps you anticipate market movements and adjust your investment strategy accordingly. As a new investor, these insights empower you to navigate the Israeli Stock Exchange confidently.

By applying the strategies discussed, you can position yourself for success, enhancing your understanding of market dynamics and boosting your investment confidence. Remember, investing is a journey that requires patience and continuous learning. Engage with relevant resources, stay updated on market trends, and consider diversity in your portfolio to mitigate risks. With the right mindset and tools, you can make informed decisions that align with your financial goals, ultimately leading to a rewarding investment experience in Israel’s vibrant stock market.

להשוואה, בדיקה וניתוח בין בתי ההשקעות

השאירו פרטים ומומחה מטעמינו יחזור אליכם בהקדם

* אין במאמר זה, בחלקו או במלואו, כל הבטחה להשגת תשואות מהשקעות ואין האמור בו מהווה ייעוץ מקצועי לבצע השקעות בתחום כזה או אחר.

- רוני מור

- •

- 6 דק’ קריאה

- •

- לפני 1 שעה

xAI ושאיפות הבינה המלאכותית של אילון מאסק: האם Grok תהפוך לטיטאן הבא בתחום ה-AI?

xAI ושאיפות הבינה המלאכותית של אילון מאסק: האם Grok תהפוך לטיטאן הבא בתחום ה-AI?

האם xAI של אילון מאסק היא הטיטאן הבא במרוץ הבינה המלאכותית? מהלכים אסטרטגיים אחרונים מצדו של אילון מאסק, הכוללים מאמצי

- לפני 1 שעה

- •

- 6 דק’ קריאה

האם xAI של אילון מאסק היא הטיטאן הבא במרוץ הבינה המלאכותית? מהלכים אסטרטגיים אחרונים מצדו של אילון מאסק, הכוללים מאמצי

- ליאור מור

- •

- 6 דק’ קריאה

- •

- לפני 2 שעה

המניות האירופיות ננעלו בעליות כאשר CAC 40 ו-Euronext מובילות את העליות

המניות האירופיות ננעלו בעליות כאשר CAC 40 ו-Euronext מובילות את העליות

שווקי המניות באירופה סיימו את יום המסחר בעלייה, כאשר רוב המדדים המרכזיים רשמו עליות על רקע שיפור בסנטימנט המשקיעים ב-15

- לפני 2 שעה

- •

- 6 דק’ קריאה

שווקי המניות באירופה סיימו את יום המסחר בעלייה, כאשר רוב המדדים המרכזיים רשמו עליות על רקע שיפור בסנטימנט המשקיעים ב-15

- ליאור מור

- •

- 4 דק’ קריאה

- •

- לפני 5 שעה

שווקי אמריקה נפתחו במגמה מעורבת כאשר מניות הטכנולוגיה מקזזות חולשה רחבה יותר

שווקי אמריקה נפתחו במגמה מעורבת כאשר מניות הטכנולוגיה מקזזות חולשה רחבה יותר

שווקי אמריקה נפתחו היום במגמה מעורבת, כאשר מניות הטכנולוגיה ממשיכות להרחיב את תנופת העליות שלהן בעוד המדדים הרחבים מציגים

- לפני 5 שעה

- •

- 4 דק’ קריאה

שווקי אמריקה נפתחו היום במגמה מעורבת, כאשר מניות הטכנולוגיה ממשיכות להרחיב את תנופת העליות שלהן בעוד המדדים הרחבים מציגים

- Articles

- •

- 5 דק’ קריאה

- •

- לפני 6 שעה

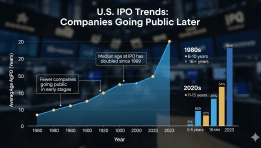

שוק ההנפקות מתבגר: גיל החברות המונפקות הגיע לשיא של 14 שנה

שוק ההנפקות מתבגר: גיל החברות המונפקות הגיע לשיא של 14 שנה

שינוי מבני בשוק ההנפקות במהלך שנות ה־80 וה־90 חברות רבות בארה״ב יצאו להנפקה בשלב מוקדם יחסית, לאחר שש עד תשע

- לפני 6 שעה

- •

- 5 דק’ קריאה

שינוי מבני בשוק ההנפקות במהלך שנות ה־80 וה־90 חברות רבות בארה״ב יצאו להנפקה בשלב מוקדם יחסית, לאחר שש עד תשע